Odoo’s one of the accounting feature - ‘Fiscal Position’ is more beneficial while we are working with multi companies / multi countries / multi states environment and we have multi taxes system. This feature helps in mapping taxes and accounts with their relative taxes and accounts as per countries or groups of countries.

For example we have one product with sales tax 15.00% but as per Indian accounting standard if we want to apply 14.00% instead of 15.00%. The simple solution is here:

-

Install Accounting and Finance

-

Activate the developer mode

-

Go to Accounting > Configuration > Accounting > Fiscal Positions.

-

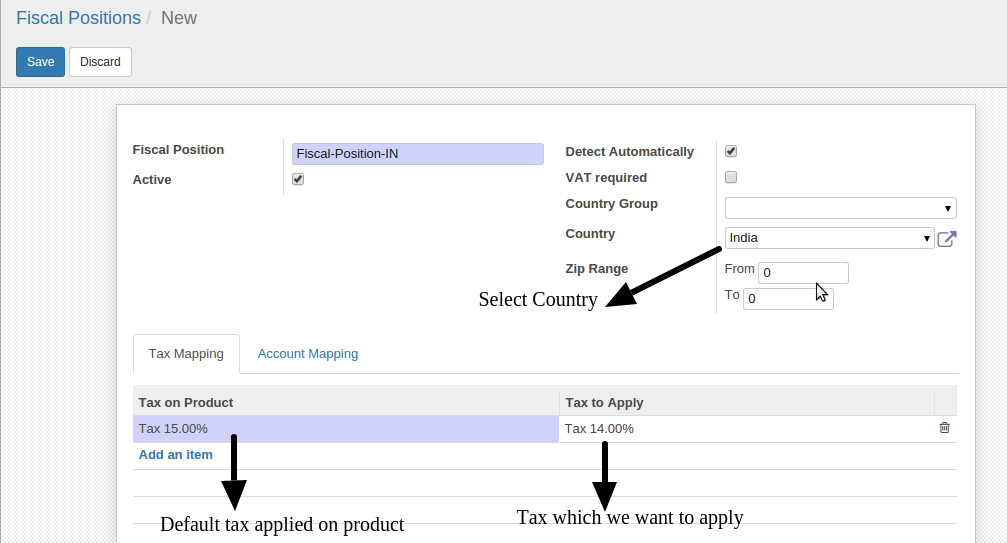

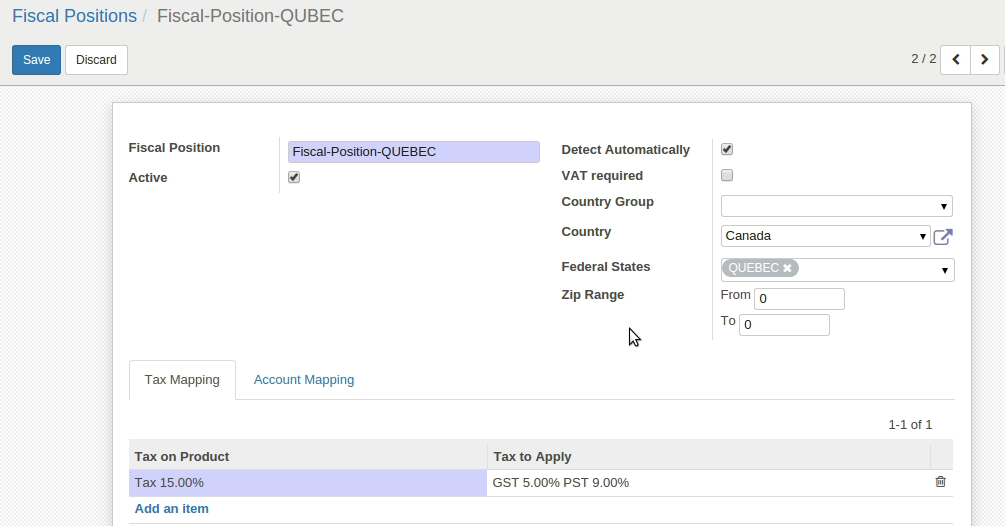

Now create a new fiscal position as below:

Note : Country and Country group option will be displayed when we checked ‘Detect Automatically.

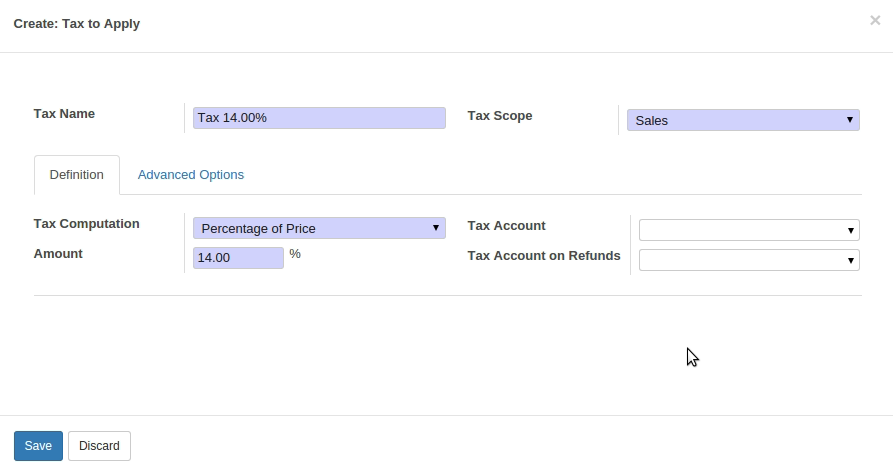

As shown in image just select the Country or Country Group and then add tax mapping. ‘Tax on Product’ is the default tax applied on product which is 15.00% and ‘Tax to Apply’ is the tax which want to apply on product i.e. 14.00%.

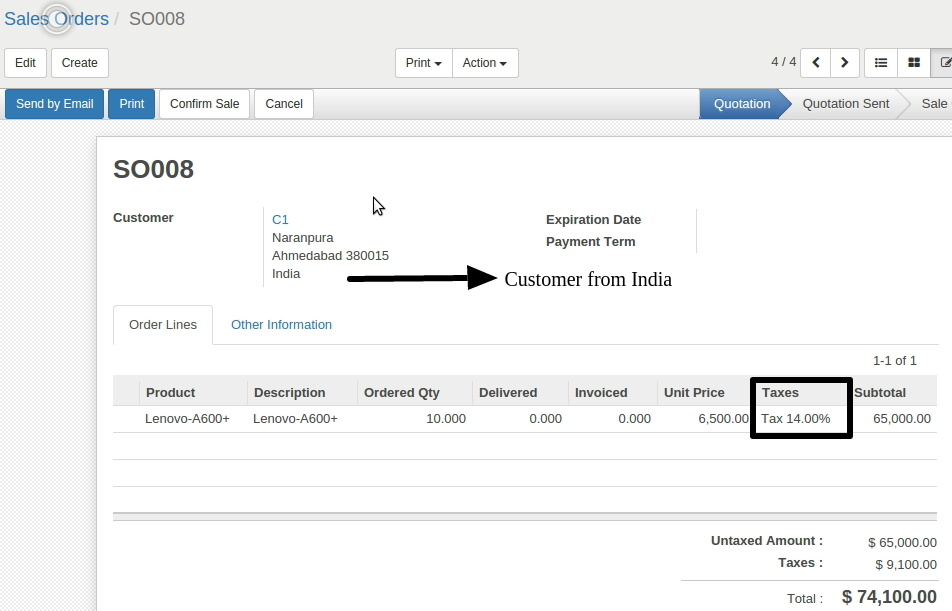

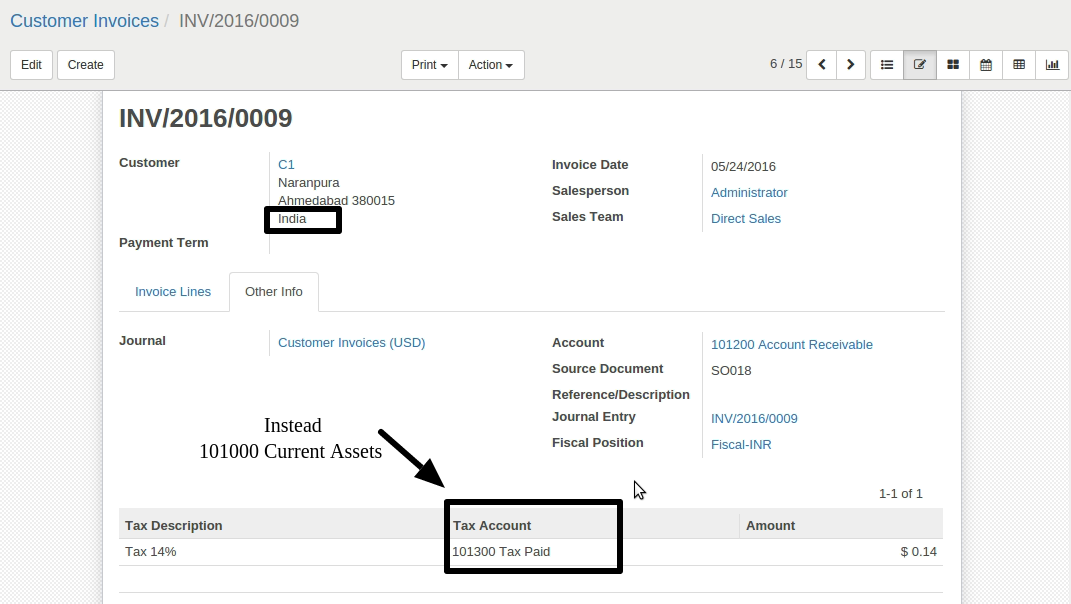

Let’s take one example, We have one customer from india. Now create sale order for that customer.

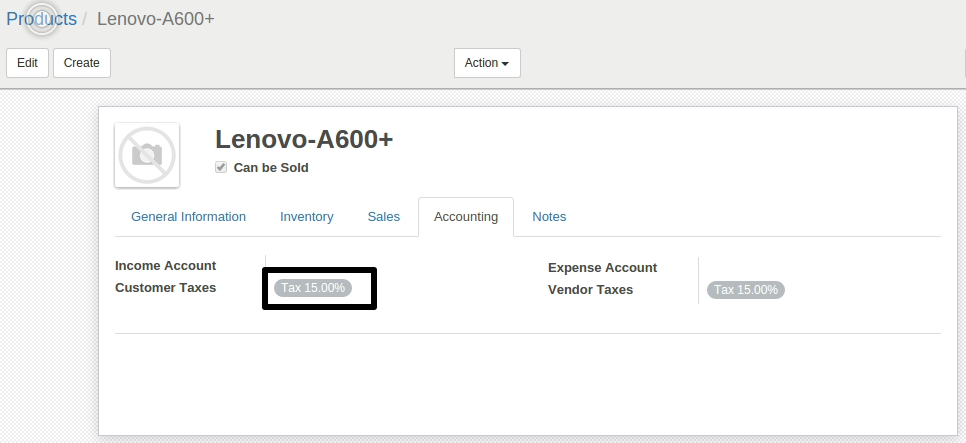

Here in above screen applied tax is 14.00% instead of 15.00%, while default sales tax of product is 15.00% as shown in below image:

Some customers may have specific tax rates which can be managed by setting Fiscal position at customer level from customer form by following below steps:

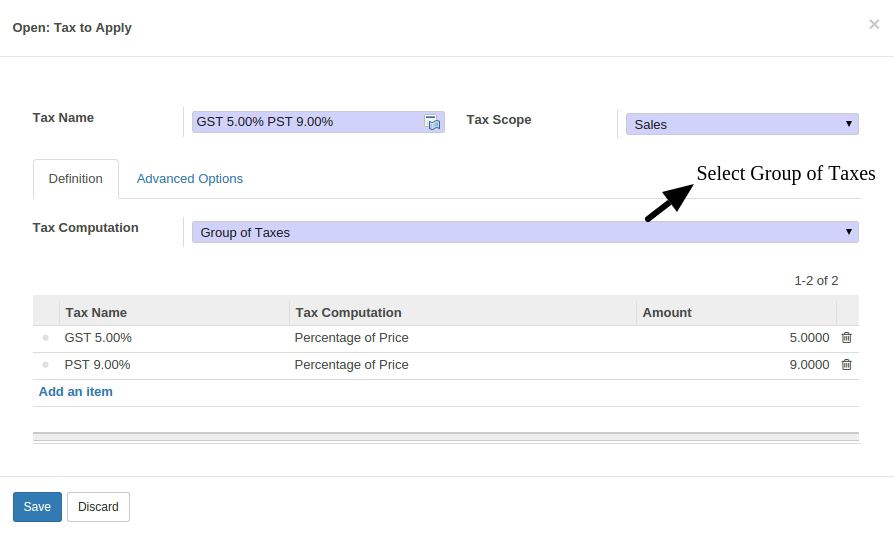

We can also handle one situation when we need to apply more than one tax on single product.

For an example, in Canada taxes are applied based on Province. Suppose a customer is from QUEBEC province of Canada, then multiple taxes are applied (GST 5% and PST 9%) on product. For that we need to create fiscal position as shown in below image:

After selecting state and country, open ‘Tax to Apply’ form(as mentioned in below image) in edit mode:

After selecting ‘Group of Taxes’ as mention in above image, you will be able to add more than one taxes.

Note: If we want to Deactivate any Fiscal Position then just untick the field Active in Fiscal position form.

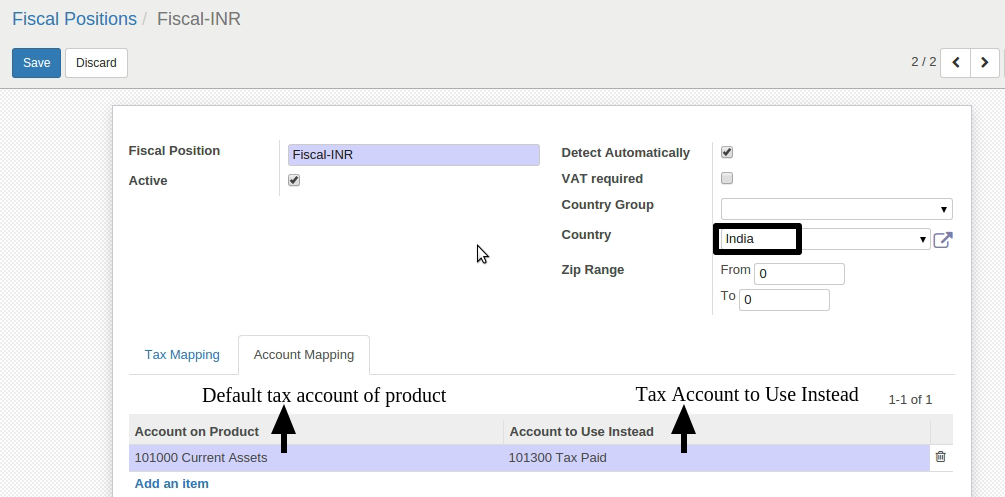

Fiscal position provides one more feature ‘Account Mapping’ from which we can change / set Relative Tax account based on different country / customer. For an example, if we want to change the default tax account based on country then we need to set account mapping as shown in below image:

Now when we create an invoice for the customer of India then Tax account will be changed from 101000 Current Assets to 101300 Tax Paid as shown in below image:

For professional paid support, you may contact us at

[email protected]

.