Over the past 20 years, the financial industry has seen significant transformation. However, it has not embraced digitalization to the same extent as other sectors. This is due to several factors, such as employee resistance, shifting regulatory environments, and lack of interest towards digitization.Positive developments have occurred in the banking sector since Liferay DXP for banking entered the market.

Liferay is not merely a software platform for the banking sector but has broad frameworks that are used by numerous businesses to get access to resources for automating tedious jobs, creating innovative solutions, and enhancing operational effectiveness. Banking organizations may accelerate digital transformation by developing cutting-edge mobile apps and websites offering cutting-edge mobile apps and websites that offer individualized client experiences with Liferay Digital Experience Platform (DXP).

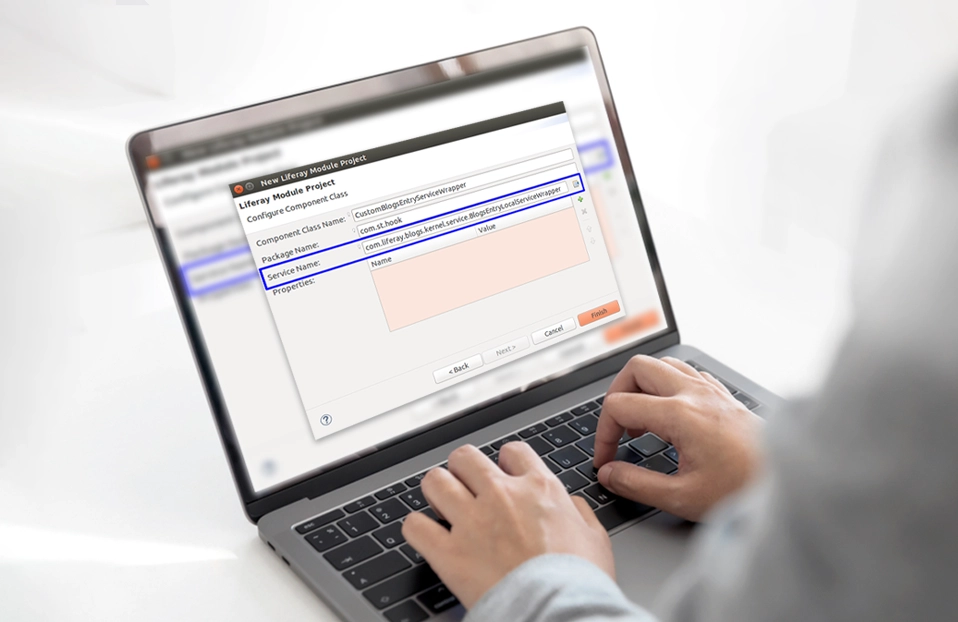

Liferay development takes a different approach than other technologies. Banking institutions and enterprise organizations (B2B, B2C, and B2E) can develop custom modules for their business needs by selecting from several Liferay DXP modules, access functions, and plugins. This blog will explain how Liferay digital experience platform has drastically changed the banking industry in the last ten years. Let's discuss.

Liferay Solutions for Transforming the Banking Industry

The fact that Liferay Portal development offers everything one needs to build a robust web portal—from document management and collaboration capabilities to user and content management and engagement—is one of its many amazing features. The exceptional part is that developers can design unique themes, portlets, and extensions that can be introduced to the platform because of its high degree of customization. These all make Liferay so unique in the banking industry.

Personalized Digital Experiences Can Be Created with Liferay

Liferay collects client information to tailor interactions, strengthening bonds and boosting loyalty by integrating with CRM systems. This results in a seamless and satisfying banking experience same as having a personal assistant at your fingertips.

Liferay Is Not Only for Users

Automating many compliance requirements that are complicated and time-consuming simplifies operations. In terms of teamwork, Liferay's social intranet capabilities enable staff members to exchange data, work together on projects, and retrieve crucial documents from any location. The platform links organizations with stakeholders, partners, and patrons, fostering a more welcoming and cooperative atmosphere.

Accessing And Managing Data Is Simple with Liferay

Institutions can use Liferay to combine several data sources from a single platform, such as external data sources, customer databases, and core banking systems. Institutions can increase overall performance and make better judgments thanks to this integrated approach to data management.

Ensuring A Simple Omnichannel Experience with Liferay

Customers now expect to be able to receive financial services through several channels, such as desktop computers, mobile devices, and branch locations. A consistent user experience for financial services is ensured for clients by Liferay's ability to build seamless omnichannel experiences across all communication channels.

When it comes to Liferay DXP for banking, it offers the advanced solutions. The way banks and other financial institutions conduct business is being completely transformed by Liferay through the provision of personalized customer experiences, optimization of processes, improvement of collaboration, integration of data management, and creation of seamless omnichannel experiences. Liferay will become more crucial in determining the direction of the finance sector as it develops further.

Impact of Liferay DXP on Banking Industry

The need for actual branches has substantially decreased because of technologies like net banking and mobile payments. Customers are becoming more selective. Financial and banking institutions should upgrade to Liferay DXP for rising demands and shifting regulations. Here are some ways that Liferay’s FinTech solutions is transforming the banking industry.

Enhanced Client Relationship

Every consumer is unique. While some might favour online banking, others could choose to go to their bank's physical locations. It becomes difficult for banking organizations to streamline consumer interactions when there are so many touchpoints. This challenge can be solved by Liferay digital experience platform in banking institutions. It helps businesses to provide a consistent user experience for all users, irrespective of the channel or device.

Assume on a holiday, a customer wishes to check his bank balance or view his statement. He does not need to contact customer support. Customers can access their account balances, make online transactions, withdraw money, and more using self-service portals. Customer satisfaction and loyalty are likely to increase when there is less reliance on physical branches and customer care agents. Additionally, the Liferay portal gathers and examines important client information that enables them to offer investment advice along with cross-selling other services and goods.

Improved Cooperation and Enhanced Productivity

Stakeholders in the banking sector include investors, regulators, risk managers, IT managers, and more. Securing efficient banking operations requires effective teamwork and communication. These stakeholders have access to a powerful platform for real-time information sharing and decision-making through Liferay DXP for banking.

Minimizing risks and running profitable businesses come from making the correct decisions at the right time. Additionally, Liferay makes it easier to share important files, documents, and other private data. Information sharing between different parties is safe and secure when a well-configured Liferay app with strong encryption and access controls is used.

Enhanced Adherence to Regulations

In the blink of an eye, the banking industry's regulatory environment can shift. For businesses, ensuring correct compliance with new legislation can be challenging. In addition to the technology and tools needed for compliance, banking organizations find it difficult to integrate new practices at every level of their business.

Banks may keep information in one central location via Liferay. Conflicts are avoided when documentation is centrally maintained and accessible to all organization members. Along with guaranteeing quality, the portal also holds each employee accountable for changes to documents (user access restrictions and permissions).

Organizations need to be aware that breaking rules can lead to legal problems and expensive fines. For both internal and external audits, banks and other financial organizations can generate customized reports automatically. Businesses can show that they comply with regulations by using these reports. Liferay also uses analytics to obtain insights and automates monotonous operations like data collection. Therefore, there's no need to fear abrupt changes in customer behavior or rules.

Integrated Systems

The basis of digitization is effective integration. Smooth banking operations are ensured by Liferay through seamless integration of systems and processes. For instance, a bank might use Excel sheets to record data on its customers. The productivity of the data entry staff determines how accurate this information is. Small errors might set off a series of events that lead to corrupt data.

In a similar vein, several banking divisions employ distinct hardware and software. There may be variations in the format and data quality. The scenario is further complicated by legacy equipment. Because of Liferay, automatic sharing and real-time data integration between many systems are now possible. For instance, a customer can update his nominee information and address online, and the changes will appear instantly on the portal, saving time on manual entry. Additionally, by taking a comprehensive approach to customer data, businesses can better understand the needs and concerns of their customers, which improves customer service.

Enhanced Development of Mobile Apps

By 2024, all investment and banking firms will need to have an app. Many consumers would rather transact online than in person at branches. By the end of 2023, more than 2500 American bank branches will have closed. 79% of clients acknowledge that digital banking innovations have significantly increased service accessibility.

Under these conditions, no business wants to lose devoted clients and customers. Banking companies can create cutting-edge apps to better serve their consumers thanks to Liferay. Just picture developers starting from scratch to create a mobile application. It would need a significant amount of time, energy, and resources.

Liferay makes it easier to create mobile apps by giving developers access to essential functionality. Developers can alter the code and produce custom apps based on the industry and customization needs. Liferay supports many Java-based languages and allows for easy code updates thanks to its extensible nature. Businesses may create mobile apps with intriguing features and functionality with these technologies.

Analytical Power

As mentioned previously, banks should be lifelong learners. One way to learn from this is to monitor consumer behavior. How do visitors to your website navigate it? Which links on service sites do they select? For what length of time did they work on each page? By integrating Liferay with analytics tools, companies may provide customized reports for every KPI and financial measure. Using this data and insights, banking tactics can be made more effective.

These data and reports cover more ground than just the standard stuff, such net interest margins, equity returns, and return on deposits. Predicting consumer behavior with historical data and real-time insights enhances risk management. Finally, data-driven insights help with investment and fund management decision-making by removing uncertainty. Additionally, these insights can be used to spot potential for growth and new business strategies.

Conclusion

As can be observed above, there have been significant repercussions from Liferay's adoption in the banking industry. Increasingly, businesses are using Liferay to develop customized websites and mobile applications to enhance their operations. Organizations can extend their operations with little downtime and investment expenses due to Liferay, which also facilitates tailored mobile app creation and content management.

Technology is ever-changing. Security, effectiveness, and productivity will increase with the use of blockchain technology, IoT connectivity, and AI and ML advancements with Liferay. Liferay will expand along with the needs and difficulties faced by the banking sector. Businesses in the banking industry should think about implementing Liferay if they want to remain relevant over time.

Allow SurekhaTech to provide you the fintech solutions for digital transformation with the robust system of Liferay DXP.