Protecting Personally Identifiable Information (PII): Liferay Portal Implementation for a Financial Institution - Surekha Technologies

Struggling with your project?

DXP | ERP | E-Commerce | AI-ML | DevOps | Bespoke Solutions

Trusted By

Protecting Personally Identifiable Information (PII) for Liferay DXP implemented at Financial Institution

Enabling government compliance in 8 Weeks for Personal Data Protection in Liferay DXP.

Our client is a leading Non-Banking Financial Company (NBFC) in India, provides personal loans, home loans, business loans, & various financial services. They are using Liferay DXP for their intranet and DMS for their multiple departments.

- Number of Employees 300+

Project Brief

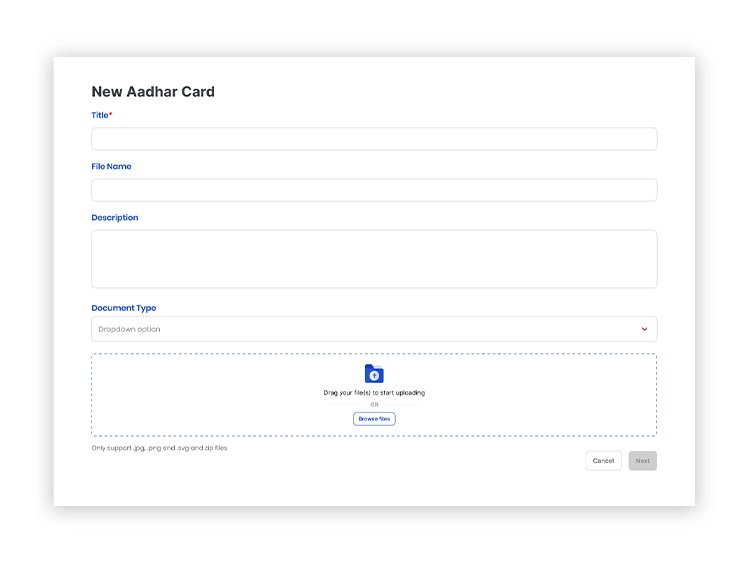

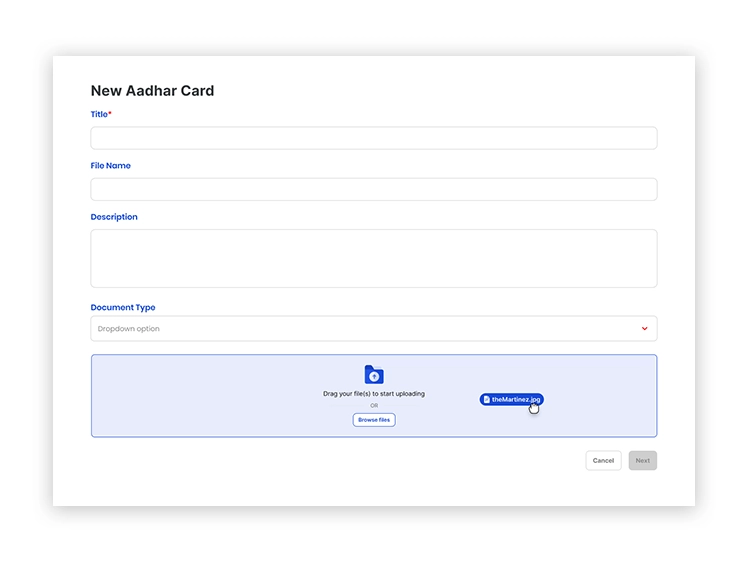

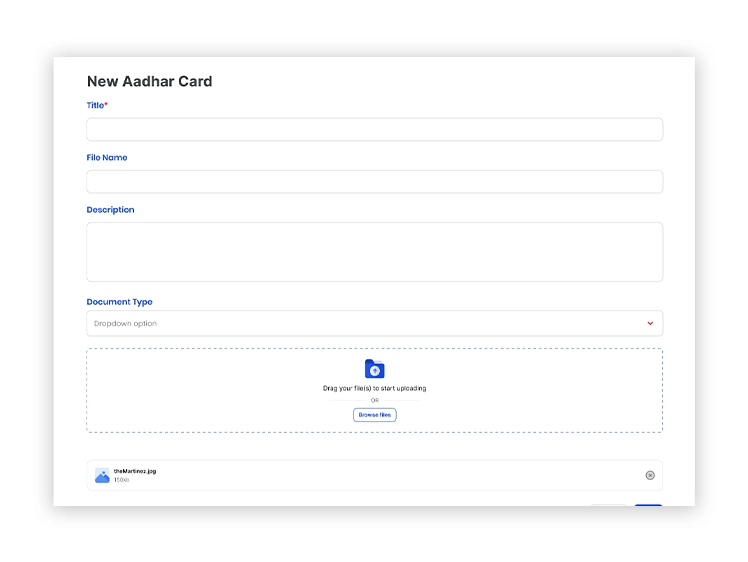

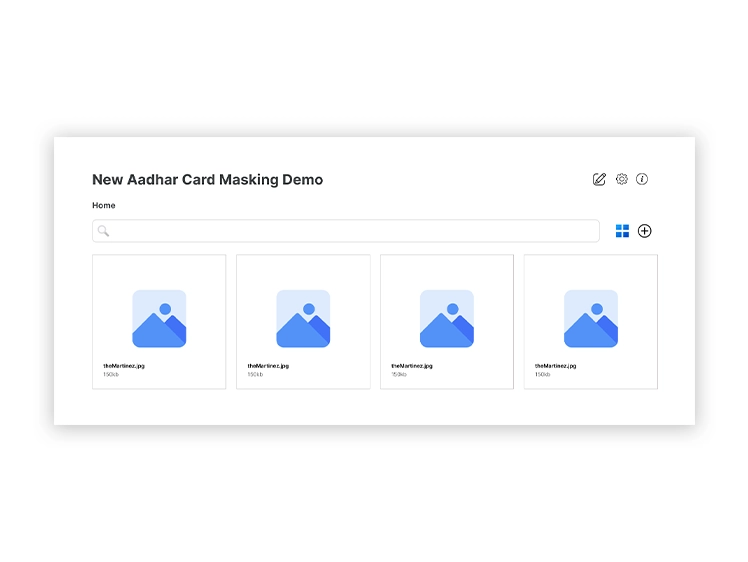

To comply with RBI guidelines for customer data security, our client sought a data masking solution that integrates seamlessly with Liferay DXP without exposing sensitive data to any third-party service providers. Given the complexity of implementing such a solution within Liferay DXP, the requirement demanded a configurable solution that allows administrators to specify the types of assets requiring masking. The assets identified for this project are Aadhar, PAN cards, etc. stored in Liferay DXP. Additionally, the solution must support both real-time and batch processing to ensure seamless integration with applications interfacing with Liferay DXP.

Business Needs & Challenges

The Institute faced regulatory pressure to ensure the security of sensitive customer information, such as PAN, Aadhaar, driving license details, etc. All cloud-based systems were required to enforce data-masking mechanisms to protect such customer data.

The data masking for such user documents must be done offline, ensuring that the data is not transferred to any third-party systems. Offline processing poses a significant challenge, as it requires robust and efficient algorithms capable of handling large volumes of data without relying on external cloud-based services.

The shorter timeline for implementation adds to the challenge, requiring rapid development and deployment of robust data masking solutions while ensuring accuracy, compatibility, and security across multiple file formats.

Masking a large set of historical data within a shorter timeline is a significant challenge, requiring highly optimised and scalable processing methods. The solution has to be efficient to handle large-scale data quickly while ensuring accuracy and minimal disruption to ongoing operations.

Technology Stack & Tools

Implementation Overview

Business Impacts

Strengthened data security with masking techniques, role-based access controls, and offline processing, safeguarding sensitive information against unauthorized access or breaches.

The solution ensured full regulatory compliance within the given timeline, addressing both historical documents and newly added records. All sensitive data was successfully masked according to compliance standards.

Previously, users had to rely on third-party tools to manually mask sensitive details before uploading documents to Liferay DXP. This manual process was time-consuming and prone to errors. With the our solution, the process has been fully automated to improve the operational efficiency for users.