Insurance Portal Solutions with Liferay - Surekha Technologies

Struggling with your project?

DXP | ERP | E-Commerce | AI-ML | DevOps | Bespoke Solutions

Trusted By

25% Consumer Base Expansion and Digital Experience Transformation with Liferay for an Insurance Company

Our client, a leading US provider of specialty insurance and risk management services, needed to enhance customer experience through digital transformation.

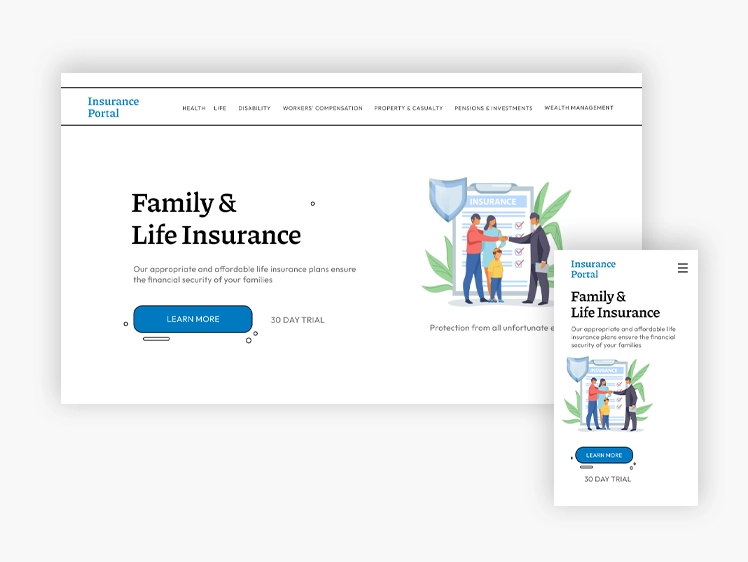

To address challenges like poor digital experience, inefficient processes, and fragmented information, we developed a comprehensive insurance portal. This portal enables customers to access information, manage claims, and receive notifications, while also improving agent productivity and operational efficiency. Our approach included consulting, custom UI/UX design, Liferay-based development, and extensive QA testing, ensuring a user-friendly platform that supports both customer and agent needs effectively.

- Number of Employees : 300+

Project Brief

Our client has been a leading provider of specialty insurance products and risk and wealth management services since 1962 in the US. The company offers a range of customized and personalized insurance solutions for organizations and individuals as well, including health, life, asset, and business insurance.

Dedicated to embracing digital transformation and enhancing the customer experience, our client aims to develop an insurance portal that will enable their customers to conveniently access their insurance information and make claims, facilitate employees in enhancing their productivity, and optimize the overall efficiency of business operations.

Business Needs & Challenges

The absence of a customer self-service portal raised various challenges for their customers, including restricted access to insurance information, time-consuming claims, and the inability to manage their insurance policies independently.

The unavailability of an insurance portal led to reliance on paperwork and manual processes, which presented challenges of increased costs, inefficiency, slower customer service, and reduced competitiveness for the client.

Our client was struggling to create a seamless and efficient claims application process for policyholders due to the incomplete integration of various data sources and customer information.

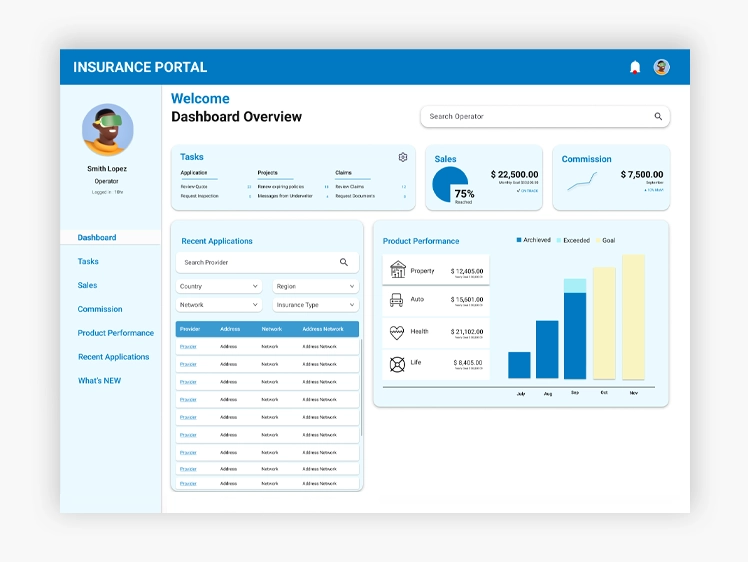

The absence of an insurance agent portal resulted in challenges for their agents, like limited customer interaction, inefficient information access, delayed real-time updates, and time-consuming onboarding.

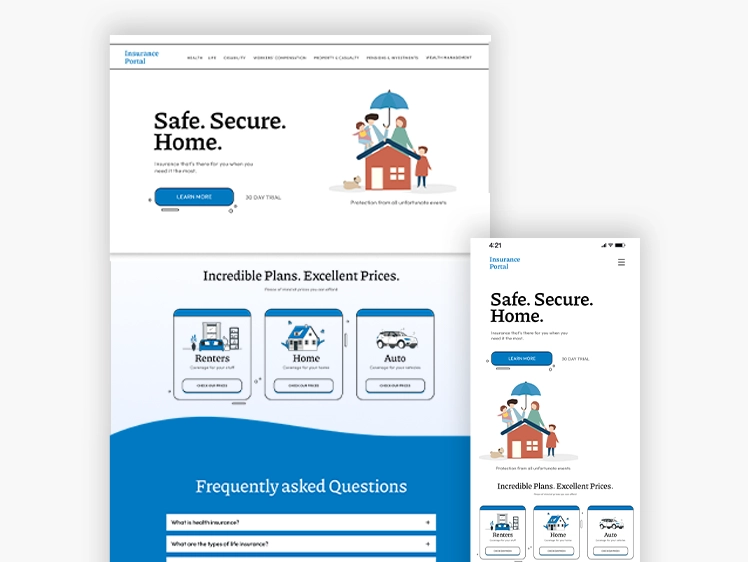

Our client was looking for an all-in-one online platform for policyholders to submit claims, track their claim status, upload multiple attachments, and receive email notifications for the insurance status.

Technology Stack & Tools

Implementation Overview

Business impacts

By unveiling a user-friendly customer portal for insurance claims, packed with new online features like single sign-on, document uploads, quick claim submissions, real-time updates, and self-service capabilities, our client significantly elevated the digital experience.

With our reliable insurance portal development services that offers quick claim submission, real-time updates, secure document uploads, and a range of other valuable features, our client's overall customer base has grown by 25%.

With easier access to customer information, policy details, market trends and insights, and a reliable communication channel, our client's agents can generate more leads and successfully close deals, resulting in an overall productivity improvement.

The adoption of our Insurance Portal Solution not only helped our client reduce operational costs through lower support calls, decreased manual labor, and improved processing times but also enabled process streamlining, task automation, and the expansion of their consumer base, ultimately resulting in a significant boost in return on investment (ROI).