Although cross-selling is a strategy that is utilized in a variety of sectors, the financial sector which includes Commercial Banking, Mortgages, Investment Banking, Portfolio/Wealth Management, and Insurance Providers finds it to be instrumental and significant. In order for the financial sector to be successful over the long term, it must maximize the value of each customer because they operate in a highly competitive market.

We have plenty of research and analysis that can depict the benefits and advantages of cross-selling in a financial institution . But since you are in a hurry, we will focus here on strategies and techniques which are significant factors in boosting businesses, “How cross-selling is different from upselling?” and “How to master cross-sell?” . Learn here about the essentials of cross-selling, what exactly cross-selling is in a financial institution, and “How to leverage Liferay DXP to enable cross-selling in the banking and financial sector?”

What is Cross-Selling?

Cross-selling is the art of selling connected or related products to an existing customer. For instance, you have a personal loan account with “XYZ Financial Service Ltd”. An approach to sell you Mutual Funds and related services besides a loan is an example of Cross-Selling in the financial sector.

Cross-Selling in Financial Sector

According to research, it has been identified that generating business from existing customers is a lot easier than from new leads. Financial services providers are able to accomplish exactly this by using cross-selling. Furthermore, it is notable that both, upselling and cross-selling, tactics are advantageous for the business, when executed appropriately. However, banking and financial institutions have been practicing cross-selling strategies more over upselling, and here’s why.

Before we go through several favorable cross-selling techniques in the banking and financial sector, let’s understand the key differences between cross-selling and upselling, and the superiority of cross-selling over upselling in the financial services industry.

Cross-selling vs Upselling

As mentioned earlier, cross-selling and upselling have advantages in their own courses of action, wherever implemented properly. In order to boost profits and provide customers with extra value, both methods are used to convince customers to buy additional goods or services. With the same purpose of generating business, the only thing that differentiates both tactics is the approach.

Upselling is all about convincing a consumer to buy an advanced class of items or services that they have planned to purchase, whereas cross-selling convinces a customer to purchase a product they already intend to purchase.

Let’s understand this with an example: 1. You are being requested to buy a platinum life insurance policy when you are planning to purchase a standard one; 2. You already bought a life insurance policy, and a sales executive tries to sell you an insurance policy for your vehicle, additionally. The first condition is an example of upselling, whereas the second one is an example of cross-selling.

Customer acquisition and customer retention are aspects that construct cross-selling efficiency in the financial services industry. Studies and research in the past discover that the ratio of success rates of a client for making purchases by an existing customer to a new customer is 60-70% to 5-20% only. The numbers mentioned here clearly depict that there are higher chances of generating business from an existing customer than from a new lead. The followings are the additional advantages of cross-selling:

- Cost-free acquisition: According to research, acquiring a new client for the business can cost up to five times higher than facilitating services for an existing customer. And by using cross-selling strategies, a business can eliminate such additional costs.

- Rewards for loyal and existing customers: In businesses, customers always look for a one-stop solution that can eliminate their efforts to switch a brand, especially when it comes to financial solutions. Cross-selling uses the same techniques and offers customers additional services.

- Increment in income: Financial service providers can make more money and provide better service to their customers at the same time by offering additional products to the customers who actually need them.

Three Cross-Selling Strategies in Financial Sector

The right methods and procedures need to be followed, in order to cross-sell advantages for both the financial sector and its customers. Cross-selling can be unfavorable if the methods and procedures are not followed properly. Financial service providers keep a customer-centric approach in their mind while cross-selling and ensure that the product they are offering to their customers is useful and relevant to them.

Enable personalization:

Easier access to customer data makes it possible for financial service providers to better understand their customers than before. Finding accurate and timely product recommendations can be made much easier by keeping track of purchase history, payment activity, channel preferences, and borrowing information. The financial service provider may anticipate their customers' expectations by using consistent and precise consumer data, rather than simply selling things that appear random to them.

Empower employees:

As employees directly deal with customers by handling inquiries, suggestions, concerns, and products, they have the most impact on customer satisfaction. The financial service provider can make relevant cross-selling recommendations if they have quick and easy access to all customer data. . When employees have reliable information, they can establish trust with customers whether they are discussing the status of a personal loan, credit card approvals, or mortgage.

Stay in touch with current customers:

In this digital era, customers' physical visit to financial institutions has reduced than they did in the past. The availability of technology and finance mobile apps has decreased the amount of face-to-face engagement. As a result, it's critical for financial service providers to remain top-of-mind, even if that means doing so through gadgets and digital platforms. Constant touch reminds the customer that your service and support is available whenever they need it. By this way, customers feel a strong relationship, and cross-selling is made simpler.

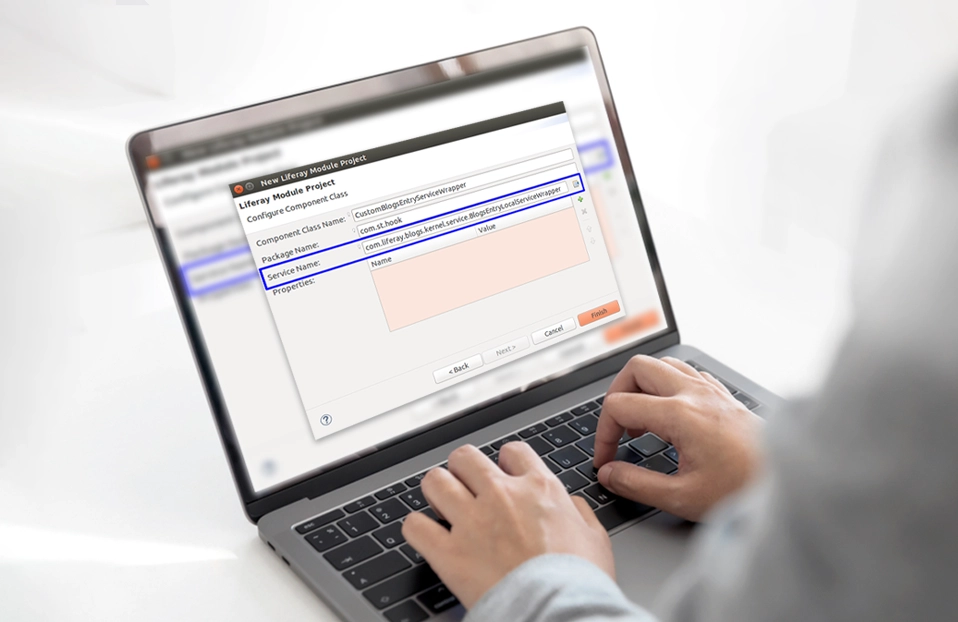

How Cross Selling Can Be Made Easier with Liferay DXP

Cross-selling is essential and successful in the financial sector. However, historically, financial service providers have faced a number of operational difficulties that can make cross-selling challenging. Liferay assists in the development of more streamlined procedures, which are necessary for a successful cross-sell. Liferay DXP services Platform can be used by financial sector for:

- Integrate customer information from various systems.

- Provide employees access to useful customer data via digital solutions to enable them to provide insightful advice.

- Bring cross-selling activities online by creating personalized digital experiences for customers that deliver the right message at the right time.

Conclusion:

It is easy to bring business from the existing customer rather than new ones. And so, cross-selling is so effective in the financial sector. Liferay development services has been offering comprehensive solutions for cross-selling through a portal. Also, several institutions like Bank of the West, S&P Global, U.S. Bank, and Desjardins have been trusting Liferay DXP for cross-selling techniques.