The global digital banking platform market is predicted to develop at a compound annual growth rate (CAGR) of 11.3% from USD 8.2 billion in 2021 to USD 13.9 billion by 2026, according to a report published by MarketsandMarkets.

To provide customers with a better experience, digital banking is evolving and driving digitalization in the industry. Technology has been transforming banks to increase their security and efficiency. However, the digital transformation of banking creates a significant curve of digital changes with the rise of Fintech, Banking as a Service, and BaaS-developing digital banking solutions.

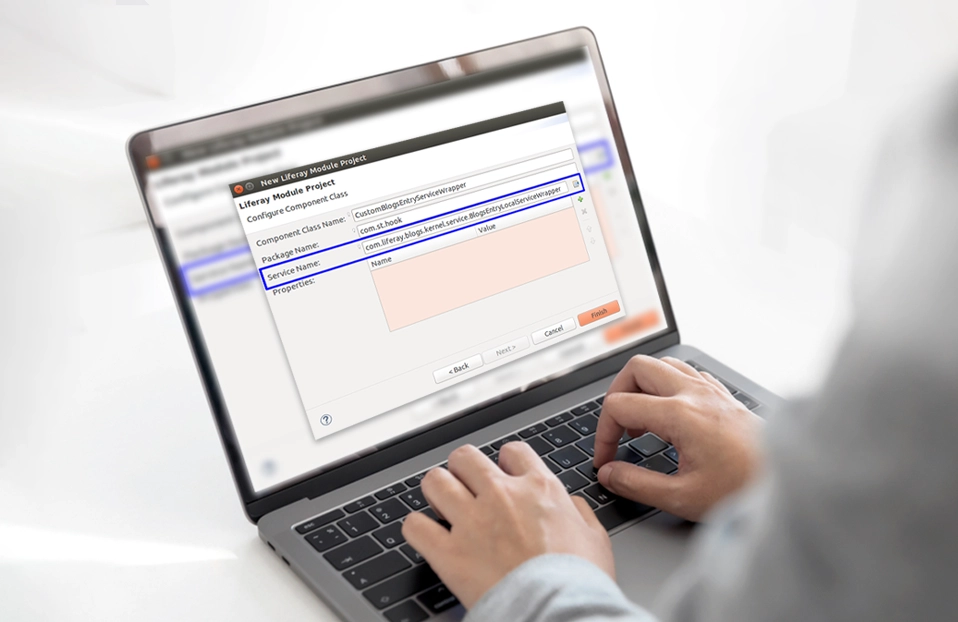

Let's continue to know about digital banking solutions with Liferay DXP.

Transforming Banking with Digital Solutions

The goal of digital transformation has always been to carry out our daily tasks in a more innovative and technologically advanced manner. The goal of digital transformation in banking is to replace all conventional methods of customer interaction and handling online and digital service channels.

Among the strategic options for digital banking are mobile applications, websites, portals, and digital channels with Fintech and other partners to provide BaaS. It involves developing a complete end-to-end omnichannel digital experience to satisfy the growing demand for improved customer service. According to the Citizens Banking Experience Survey, 86% of enterprises and 90% of consumers use digital banking channels.

Transforming banking using Digital Experience Platform

A portal serves as an integrated platform for handling all customer journey touchpoints. Liferay DXP is a scalable and adaptable portal platform with a wide range of use cases to address every possible touchpoint throughout the customer's journey. It also easily combines diverse systems.

Liferay's platform has gained recognition from several global banks and financial institutions due to its fundamental construction materials and emphasis on security by design. As we transition to a digital age, multinational corporations want their systems to be scalable in many ways, including quicker installation, reduced reliance, and simpler configuration and product launch procedures.

Banks have been implementing various digital solutions based on their requirements for several decades. Technology has been changing and will keep changing in the future. Automation of processes and the application of cutting-edge technologies like AI, ML, and IoT have been made possible by Industry 4.0, ushering in an entirely new era of technological advancements that are revolutionizing business. Portal systems featuring DXPs are regarded as cautious, economical, and non-fragile among digital solutions.

How Liferay DXP is Transforming Banking: 3 Key Applications

1. Self-service portal

Banks are among the many industries that use self-service. According to a Microsoft study, 77% of customers say they use self-service portals.

Along with the mobile-first strategy, self-service is one of the most significant methods that banks have implemented to enhance the client experience.

2. Platform of Integration

Creating a single platform to view and access all necessary functionalities for all dissimilar systems benefits the customer.

Carrefour Financial Solutions upgraded to Liferay Experience Cloud Self-Managed (Self-Service Portal), resolving backup and security issues. This migration improved scalability, reduced deployment time from 4 hours to under 10 minutes, enhanced flexibility, supported quicker launch of new services, and maintained strong portal performance through a platform integration with Liferay.

Ref. - https://www.liferay.com/resources/case-studies/carrefour-financial-services

3. Public Portal

To improve organizations and their service, this assists the firm in showcasing its value proposition, identifying the client, and channeling prospects.

Liferay's Digital Experience Platform (DXP) on the Banking Industry uses data to provide more individualized and improved experiences.

Banco do Nordeste (BNB) upgraded its digital platforms to Liferay, streamlining management and improving user experience. The new public portal features faster service delivery, better content management, and a 24% reduction in page load times. This upgrade, supported by Liferay and Pitang, has enhanced interactions for both clients and employees, meeting evolving needs and market trends.

Ref. - https://www.liferay.com/web/guest/resources/case-studies/banco-do-nordeste

Success Stories of Liferay DXP in Finance Industry

Explore how SurekhaTech has leveraged Liferay DXP to transform digitally and streamline processes for financial institutions.

1. Multi-Site Development with Liferay DXP for an Insurance & Finance Firm

A multi-line insurance and financial services company with 15 websites faced high costs and inefficiencies. We migrated their sites to a unified Liferay DXP platform, cutting server costs by 50% and reducing developer dependency. The new low-code portal and automated tasks improved management, and personalized content across six countries, and boosted quote requests by 34%.

Ref. - /digital-experience-portals-for-multi-line-insurance-and-finance-firm

2. Document Management Portal in Liferay 7.4 for India's Financial Institution

An Indian financial institution faced issues with document security, multi-language support, and site management. We implemented Liferay 7.4 DXP, integrated Elasticsearch for advanced search, and developed custom content approval workflows. The solution also included multi-language support, user notifications, and unified site management.

Ref. - /liferay-dxp-portal-for-financial-institution

Key Benefits of Liferay DXP for Banks

Omnichannel Experiences

An omnichannel experience ensures that customers receive information through a variety of channels seamlessly. This helps the company in targeting its clientele based on how they interact with it across various channels.

A Cloud-based Foundation

Financial organizations use a hybrid cloud strategy that enables them to maintain several architectures from a single Liferay infrastructure.

Additionally, businesses are increasing their investments since they complement security and disaster recovery.

Integration of legacy systems

Integrating the legacy system is one of the main problems of the digital transformation process. Liferay DXP simplifies system integration, creating a unified platform.

Conclusion

Digital transformation can be a complex process for any organization. However, with Liferay DXP solutions, the transformation for SaaS and PaaS can be simplified.

The Liferay development experts at SurekhaTech can help with customized solutions for your business.